Bring in Cash Watching Ads with AdzBazar: Complete Aide

Outline:

1. Introduction

2. What is AdzBazar?

3. How Does AdzBazar Work?

4. Tips to Lift Your Pay

6. Benefits of Using AdzBazar

7. Ending

8. FAQs

Bring in Cash Watching Ads with AdzBazar: Complete Aide

1. Introduction

In the present motorized age, finding ways to deal with gaining additional cash online has become ceaselessly striking. One such entryway is getting cash by watching advancements. AdzBazar is a phase that offers clients the chance to get made up for simple survey promotions. This article will research AdzBazar capabilities, how you can increase your benefit, and the upsides of using this stage.

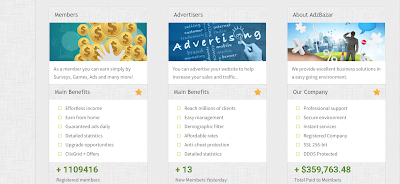

2. What is AdzBazar?

AdzBazar is a web advancing stage that partners support with likely clients. Supports pay AdzBazar to show their advancements to an assigned group, and AdzBazar bestows a piece of that pay to its clients. By watching these advancements, clients can get cash directly into their AdzBazar accounts.

3. How Does AdzBazar Work?

a. Join: The underlying move toward start gaining with AdzBazar is to make a record. The selection connection is essential and free. You just need to give your fundamental nuances and browse your email address.

b. Watch Promotions: When you have a record, you can start watching ads. AdzBazar offers various commercials, going from brief video catches to longer promotions. Each advancement has a specific study time, and you ought to watch the entire promotion to obtain credit.

c. Bring in Cash: Ensuing to watching an advancement, your record will be credited with a particular proportion of money. The aggregate you secure per advancement shifts depending upon the promotion's length and the support's monetary arrangement.

d. Pull out Income: When your record balance shows up at the base payout edge, you can request a withdrawal. AdzBazar offers different portion systems, including PayPal, bank move, and cryptographic cash.

4. Tips to Lift Your Pay

a. Observe More Advertisements: The more advancements you watch, the more money you can procure. Endeavor to commit a specific proportion of time consistently to watching advancements to grow your pay.

b. Allude Companions: AdzBazar has a reference program that licenses you to get a commission for each friend you imply the stage. Share your external reference by means of online diversion or with friends and family to construct your benefit.

c. Complete Offers: Other than watching ads, AdzBazar similarly offers additional approaches to getting cash, such as completing examinations, chasing after free starters, and participating in restricted time offers.

d. Remain Dynamic: Regularly sign into your AdzBazar record to check for new advancements and offers. Staying dynamic promises you miss no gaining open entryways.

6. Benefits of Using AdzBazar

a. Adaptability: AdzBazar grants you to get cash from any spot at whatever point. You can watch advancements on your PC or mobile phone, making it a versatile strategy for bringing in extra cash.

b. No Theory Required: Dissimilar to other web-based rewarding methods that require a hidden endeavor, AdzBazar is completely permitted to join and use. You can start getting cash without spending a dime.

c. Simple to Utilize: The stage is straightforward and easy to investigate. Whether or not you're taught, you'll find it simple to watch commercials and acquire cash.

d. Dependable Installments: AdzBazar has acquired reputation for ideal and strong portions. You can accept that your benefit will be credited to your record and eliminated with practically zero issues.

7. Ending

AdzBazar offers an immediate and supportive strategy for getting cash by watching advancements. Whether you want to bring in some extra cash in your additional time or searching for a versatile online entryway, AdzBazar merits considering. Join today, start watching notices, and see how quickly your benefits can add up. Delighted securing!

FAQs

1. What sum could I anytime obtain by watching advancements on AdzBazar?

The aggregate you can get on AdzBazar varies considering the amount of advancements you watch and the sort of ads open. Each advancement has a substitute payout, ordinarily going from two or three pennies to a couple of bucks. Your benefit will depend on how long you focus on watching commercials and participating in other open offers.

2. Is there a base payout limit on AdzBazar?

For sure, AdzBazar has a base payout limit that you truly need to reach before you can take out your benefit. The cutoff aggregate could vary, so checking the continuous necessities on the AdzBazar site is principal. At the point when you show up at the cutoff, you can request a payout through various portion strategies, for instance, PayPal, bank move, or computerized money.

3. Are there substitute approaches to getting cash on AdzBazar other than watching notices?

Completely! As well as watching notices, AdzBazar offers a couple of other obtaining open entryways. These consolidate completing examinations, seeking after free fundamentals, participating in unique offers, and implying allies to the stage. Taking advantage of these additional techniques can help you with intensifying your pay.

4. Is AdzBazar open all over the planet?

AdzBazar is available to clients from various countries all around the planet. Regardless, the openness of ads and offers could change considering your region. A couple of regions could have more getting possible entryways than others. It's ideal to check the AdzBazar site for express bits of knowledge about your country.

5. How might I ensure I get credited for watching an advancement on AdzBazar?

To promise you get credited for watching an advancement, you ought to watch the entire commercial without keeping away from any part. AdzBazar tracks your review development, and expecting that you disregard to watch the full advancement, you may not get credit. Also, guarantee you're endorsed into your AdzBazar account while watching notices to ensure authentic following and crediting of your benefit.

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)